The Definitive Guide to Home Warranty Claim

Wiki Article

A Biased View of Home Warranty Claim

Table of ContentsThe 6-Minute Rule for Home Warranty ClaimHome Warranty Claim for BeginnersTop Guidelines Of Home Warranty ClaimSome Known Incorrect Statements About Home Warranty Claim The Best Strategy To Use For Home Warranty ClaimHome Warranty Claim for Dummies

Residence insurance coverage might additionally cover medical expenses for injuries that individuals endured by being on your residential property. A property owner pays a yearly premium to their house owner's insurance provider. On average, this is somewhere between $300-$1,000 a year, relying on the plan. When something is damaged by a calamity that is covered under the house insurance coverage, a home owner will call their house insurance provider to submit a claim.

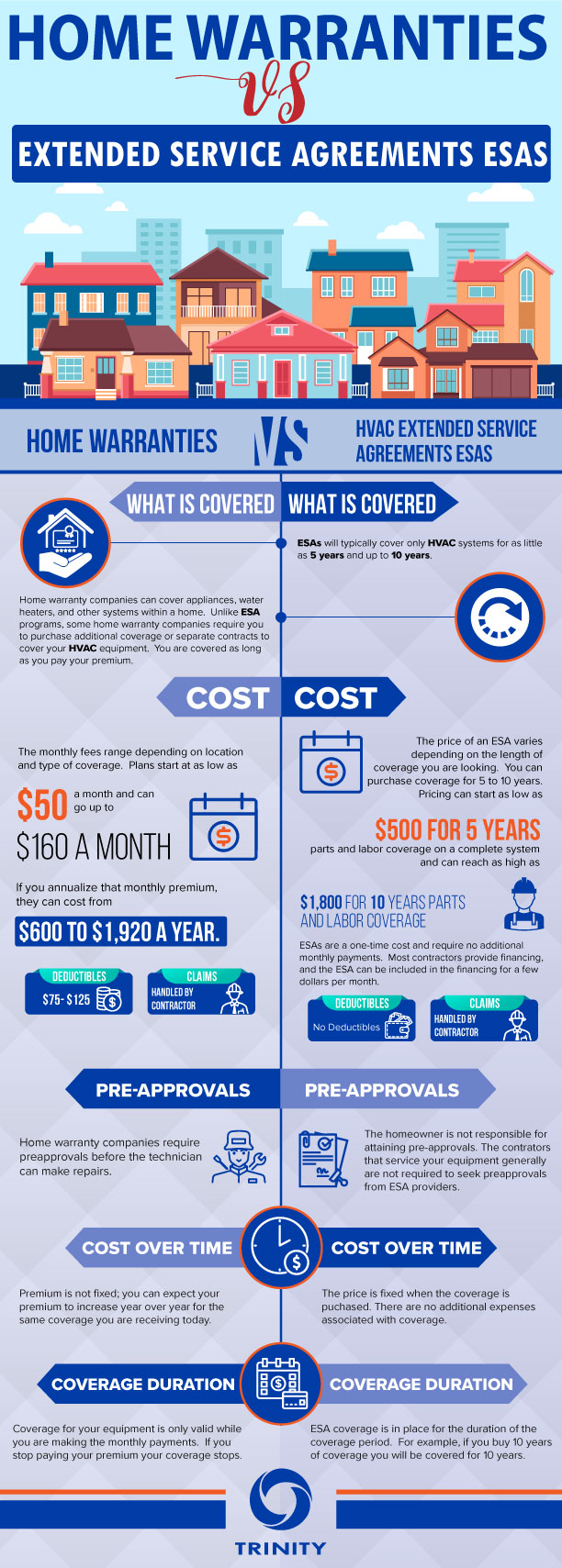

What is the Distinction In Between Residence Guarantee as well as Home Insurance A house guarantee contract as well as a residence insurance coverage run in similar ways. Both have a yearly premium and an insurance deductible, although a house insurance coverage premium and deductible is often much more than a home service warranty's (home warranty claim). The main differences in between house guarantees and home insurance are what they cover.

The Definitive Guide for Home Warranty Claim

Another difference between a home warranty as well as home insurance coverage is that home insurance coverage is generally required for house owners (if they have a home mortgage on their house) while a home guarantee strategy is not needed. A home warranty and also house insurance coverage provide defense on various components of a home, and also together they can protect a homeowner's spending plan from costly repair work when they inevitably emerge.If there is damage done to the framework of the house, the owner will not have to pay the high prices to repair it if they have house insurance. If the damages to the house's framework or home owner's possessions was caused by a malfunctioning home appliances or systems, a residence service warranty can assist to cover the pricey repair work or substitute if the system or appliance has actually fallen short from typical wear and tear.

They will interact to provide protection on every part of your home. If you have an interest in buying a residence guarantee for your house, have a look at Site's home warranty plans as well as prices here, or demand a quote for your house below.

The 7-Second Trick For Home Warranty Claim

In a best-seller's market where house buyers are forgoing the residence evaluation contingency, buying a home guarantee can be a balm for stress over prospective unknowns. To get the most out of a home warranty, it's essential to read the small print so you recognize what's covered and also just how the strategy works prior to authorizing up.The distinction is that a residence guarantee covers a variety of products as opposed to just one. There are 3 basic kinds of home warranty strategies. System intends cover your house's mechanical systems, including home heating and also air conditioning, electric and plumbing. Device plans cover major home appliances, like the dishwashing machine, oven and cleaning maker.

Not known Factual Statements About Home Warranty Claim

Builder service warranties generally do not cover devices, though in a brand name new home with new home appliances, makers' guarantees are likely still in play. If you're getting a residence warranty for a brand-new residence either new building or a house that's brand-new to you insurance coverage usually Check Out Your URL begins when you close., your house warranty business might not cover it. Rather than depending only on a guarantee, attempt to negotiate with the seller to either correct the problem or give you a credit score to assist cover the cost of having it fixed.

You do not have to research as well as obtain recommendations to find a tradesperson every single time you require something fixed. The other hand of that is that you'll obtain whomever the home warranty firm sends to do the assessment and also make the repair work. You can not select a professional (or do the job on your own) and also after that obtain repaid.

Some Known Incorrect Statements About Home Warranty Claim

For one, homeowners insurance coverage is needed by lenders in order to acquire a home mortgage, while a residence service warranty is totally optional. As mentioned over, a home service warranty covers the repair service and substitute of items and also systems in your home.Your home owners insurance coverage, on the various other hand, covers the unexpected. It will not help you change your devices because they obtained old, yet property owners insurance might help you get new devices if your existing ones are harmed in a fire or flooding.

Exactly how a lot have a peek at this site does a home warranty expense? House guarantees normally set you back in between $300 and also $600 per year; the price will certainly differ depending on the kind of strategy you have.

Home Warranty Claim Fundamentals Explained

Report this wiki page